The Quiet Revolution that Matters

Every cycle of technological change produces its own mythology. Today, that mythology is dominated by the “hyperscalers” and the eye-watering valuations pinned to a handful of firms. Commentators point to market froth, circular investment flows, or the fact that so many AI “wins” still depend on subsidized infrastructure. From the standpoint of investors, these are real concerns. Valuations are not strategy, and a bubble in big tech multiples is always a risk.

The FT has just published an article on this.

But to conclude as the FT does that AI is “little more than FOMO” is to miss the story playing out in the places that matter most. AI is not confined to chatbots or grandiose moonshots. It is already reshaping the work of banks, insurers, hospitals, and governments — institutions whose daily operations carry real consequences.

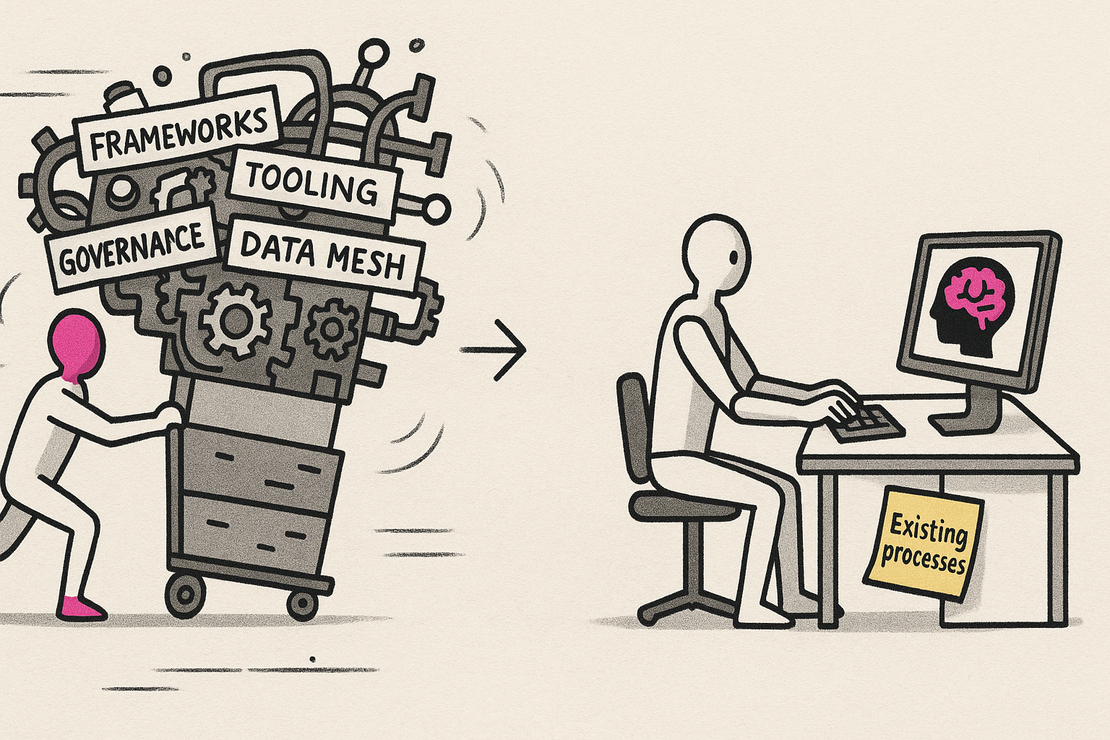

Take risk management in financial services. For decades, banks have wrestled with the trade-off between speed and prudence. Policies pile up, controls proliferate, and compliance delays innovation. The result: opportunity costs for customers and friction for frontline teams. Here is where AI is quietly breaking the deadlock.

With AI tools like re:agent, risk and compliance work becomes more livable, and many times more reliable. Guidance sits in the flow of work, so managers spend less time chasing paperwork and more time on real judgment calls. Banks can grow without adding endless layers of staff and consultants — making prudential management a foundation for scale, not a chain holding it back.

This is Roy Amara’s truism in action: we overestimate the short-term impact of a technology, and underestimate its long-term effect. The noise around valuations may prove fleeting. But the long-term effect of embedding intelligence into the control fabric of the enterprise will be profound — a wholesale transformation in how the economy organizes work.

So the real question is not whether the “Magnificent Seven” (or eight, or nine, as Oracle and others join the club) can keep delivering growth that matches their multiples. Investors may well be advised to hedge that risk. The more urgent question for corporate managers is different: how do you lead in the coming sea change?

The answer is to focus on the problem in front of you. For banks, that problem is the tangle of operational risk, regulatory expectations, and the constant demand to do more with less. For healthcare, it is safety, privacy, and patient throughput. For government, it is trust and efficiency. These are not solved by betting on who wins the GPU wars. They are solved by applying AI in context, with prudence and accountability built in.

At Rational Exponent, we believe the quiet revolution underway in these niches is the one that matters. The valuations may rise and fall, but the shift in how work is done — prudent by design, nimble by nature — will outlast any market cycle.